Child Tax Credit 2014 Income Limit – The Internal Revenue Service (IRS) has announced new income phase-out limits for the Child Tax Credit, set to take effect in 2024. TRAVERSE CITY, MI, US, January 17, 2024 /EINPresswire / — The . The changes to the child tax credit will primarily target low-income families There is also a very limited window to approve the deal, as it would need to pass before the end of January .

Child Tax Credit 2014 Income Limit

Source : www.blog.rapidtax.com

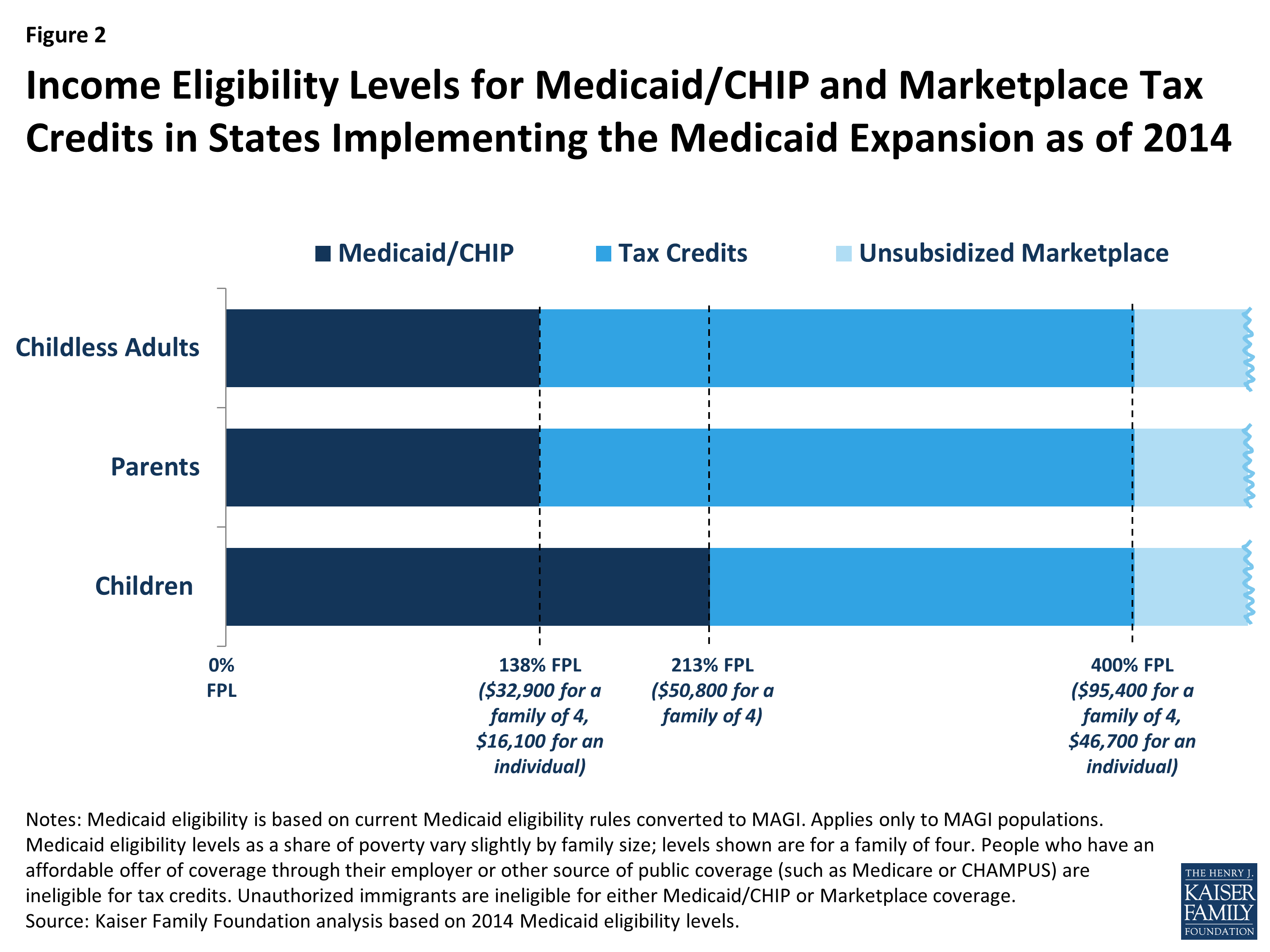

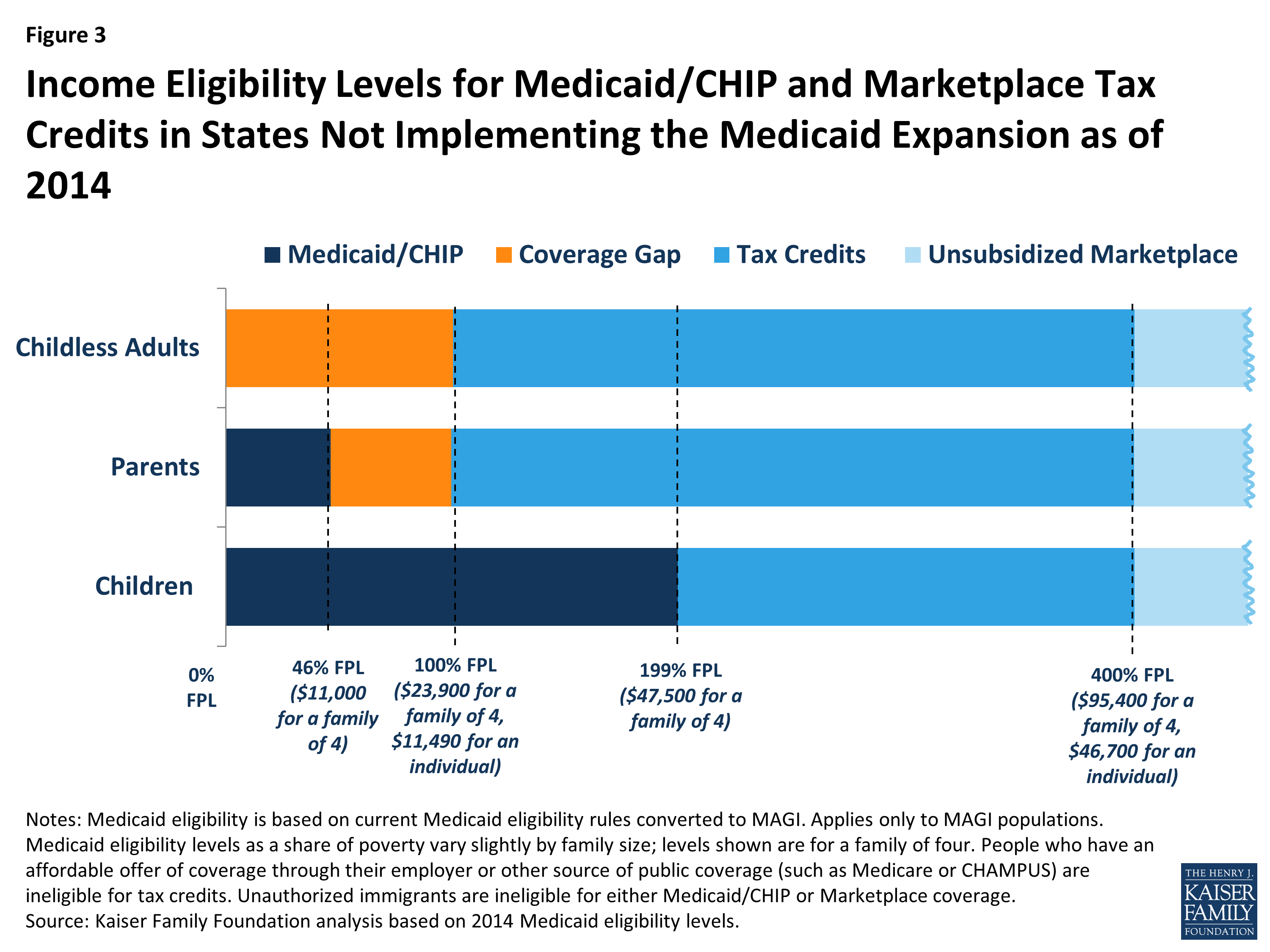

How Will the Uninsured Fare Under the Affordable Care Act? | KFF

Source : www.kff.org

Premium Tax Credit Charts 2015

Source : www.peoplekeep.com

How Will the Uninsured Fare Under the Affordable Care Act? | KFF

Source : www.kff.org

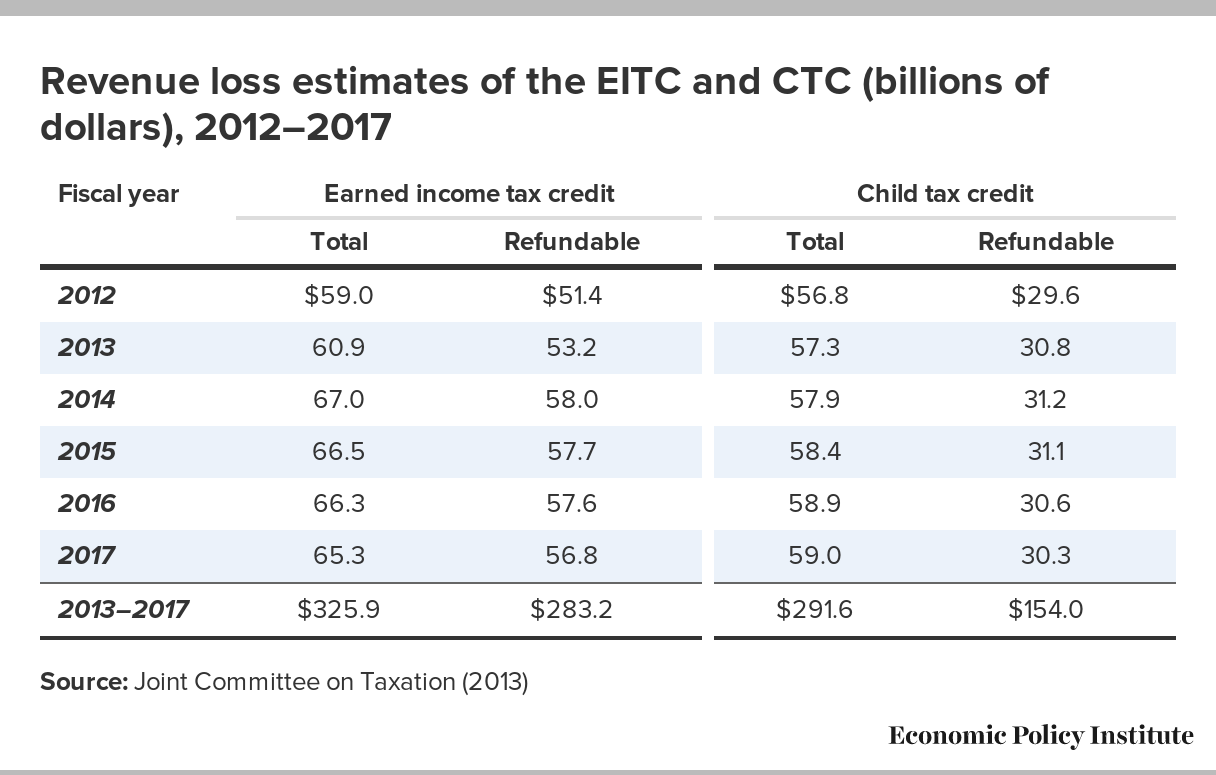

The Earned Income Tax Credit and the Child Tax Credit: History

Source : www.epi.org

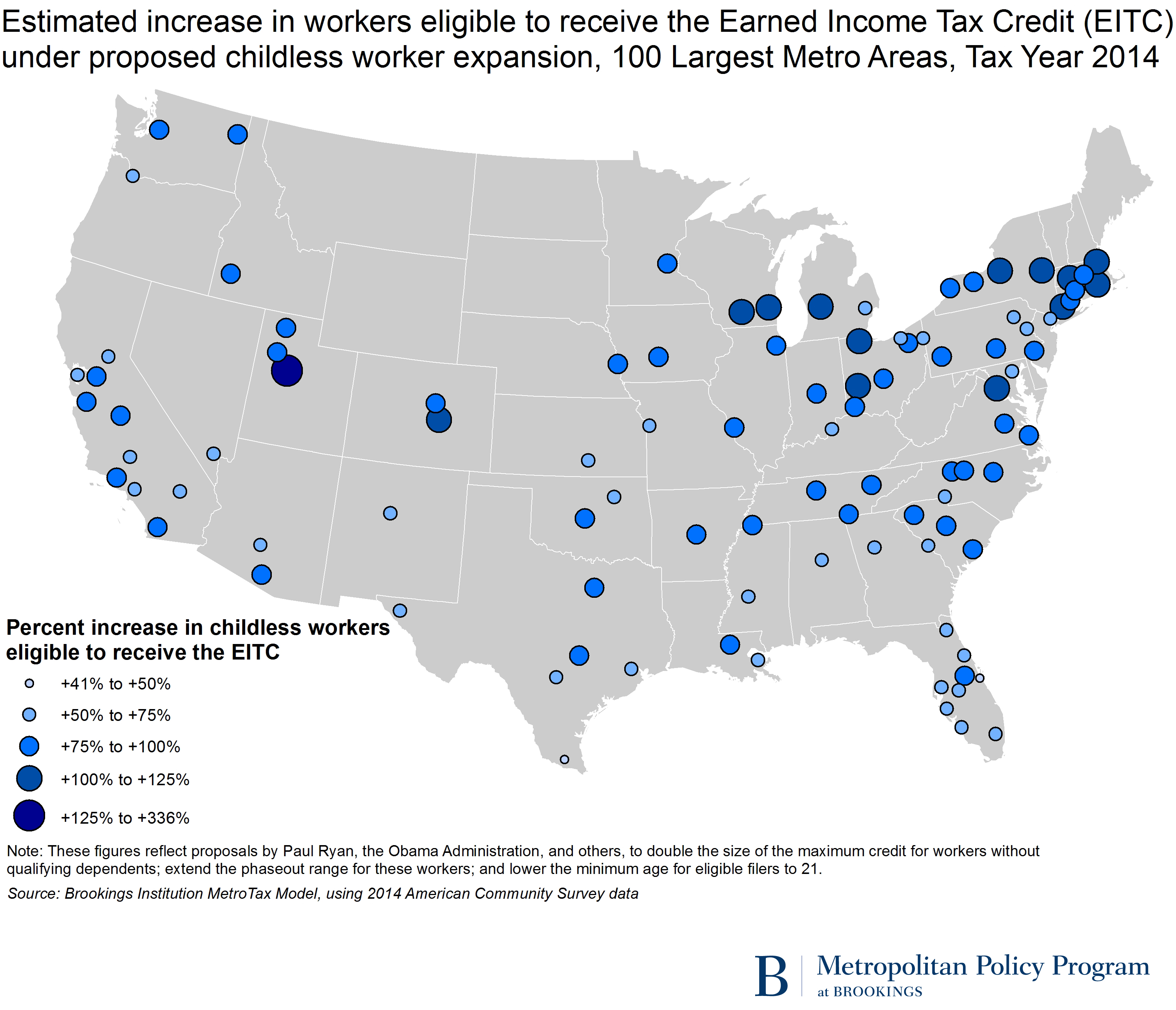

Strategies to strengthen the Earned Income Tax Credit | Brookings

Source : www.brookings.edu

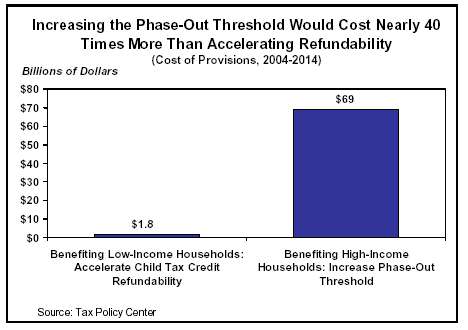

House Bill Adds $69 Billion In Deficit, 5/18/04

Source : www.cbpp.org

Will I qualify for the Earned Income Tax Credit (EITC)?

Source : igotmyrefund.com

About 16 Million Children in Low Income Families Would Gain in

Source : www.cbpp.org

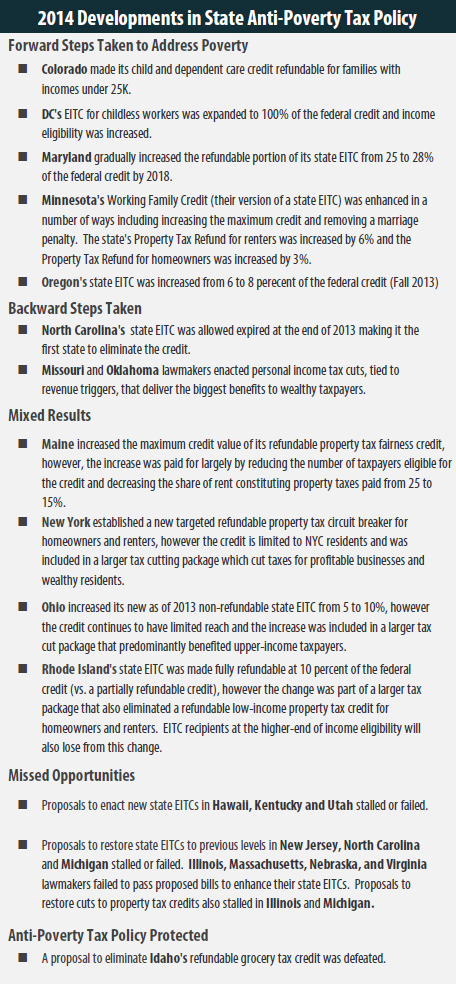

State Tax Codes As Poverty Fighting Tools – ITEP

Source : itep.org

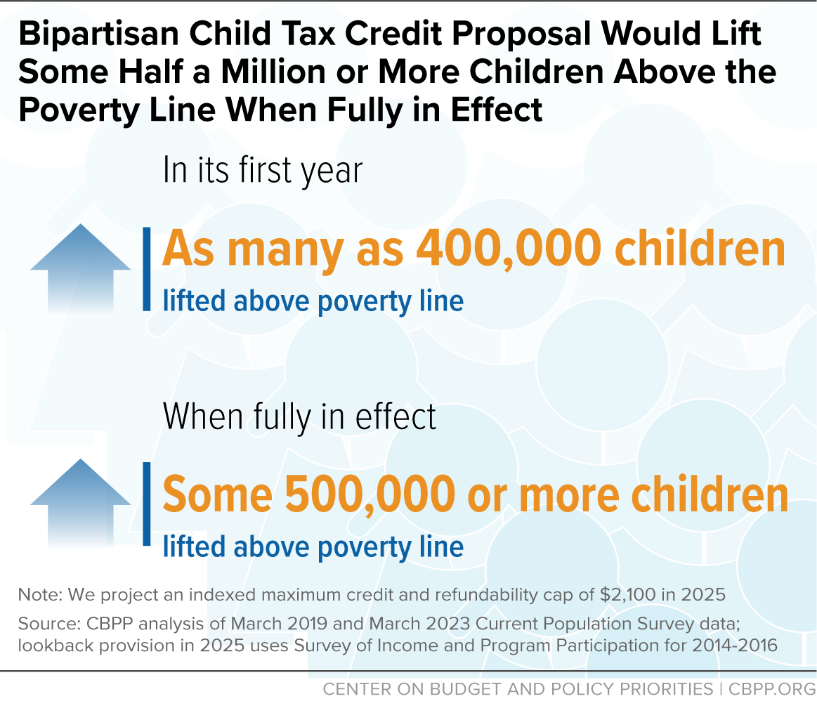

Child Tax Credit 2014 Income Limit What Is The 2013 Child Tax Credit & Additonal Child Tax Credit?: Child Tax Credit 2024 Income Limits: What is the income limits for this year? There is a major difference between a credit that is refundable and the one that is not refundable. To be clear . Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025. .